Budget 2026

Administration presented an Operating Budget of $484.5 million and a Capital Budget of $63.9 million, including a proposed property tax increase of 7.36 per cent. Following a series of changes put forward by Council, the budget was approved with a final municipal tax rate of 3.97 per cent. The revised Operating Budget comes in at $482.6 million and the Capital Budget at $63.9 million.

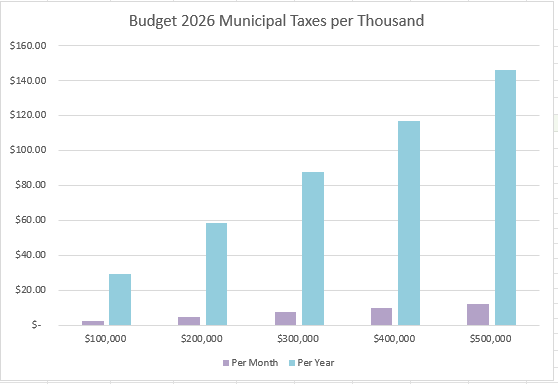

The approved municipal tax increase of 3.97 per cent represents an increase of approximately $29.24 per year or $2.44 per month for every $100,000 of assessed residential value for a single-family home.

*Chart is based on 2026 Interim Budget Approval

Budget 2026 is a lean and responsible budget that focuses on maintaining essential services, managing costs carefully, and supporting long-term financial sustainability. The budget includes few new spending requests and no proposed service level reductions, while addressing unavoidable cost pressures such as inflation, contractual obligations, increasing operational costs and slowed growth.

What to Expect from Budget 2026

- A lean and responsible approach: Budget 2026 prioritizes maintaining the services Red Deerians rely on every day. Most new requests relate to required commitments such as the RCMP policing contract and personnel provision. Overall, the budget emphasizes stability, cost management, and long-term financial health.

- Investment in essential infrastructure: The proposed capital budget focuses on protecting and renewing existing infrastructure — such as roads, facilities, parks, and utilities — using a disciplined, priority-based approach. Some projects are phased or deferred to manage costs responsibly.

- Strengthening Red Deer’s financial position: Thanks to the difficult decisions made in the 2025 budget, The City enters 2026 in a stronger financial position. Reserve levels are improving, financial risks are decreasing, and The City continues to work toward its long-term Financial Roadmap.

- A tax change shaped by ongoing financial pressures: Even though Budget 2026 is a lean plan with limited new spending, The City continues to face significant economic pressures that affect the cost of delivering essential services, including:

- Rising inflation and operating costs, impacting everything from fuel to construction materials.

- Decreased grants from other levels of government.

- Slowed growth, which affects revenue.

- Property taxes not keeping pace with the cost of services - past years of zero or below-average increases are not sustainable and often lead to higher adjustments in future years.

These pressures, combined with contractual obligations such as the RCMP policing contract and the personnel provision, directly influence the proposed tax change in the draft budget.

The recommended adjustment helps maintain essential services, support long-term financial health, and ensure The City can continue meeting community needs. Council will review and make final decisions during budget deliberations in December.

Get Involved

- Review the full budget, including Operating Budget, Capital Budget, Executive Summary, and departmental details: 2026 Proposed Budget (pdf)

- Read the Budget Frequently Asked Questions for more information.

Understanding the Budget: Where Your Tax Dollars Go

Creating a municipal budget means balancing the services our community expects with the funding available to deliver them.

To help you better understand how The City’s budget works, we’ve created resources that explain:

- Where City revenue comes from (did you know property taxes only account for 40% of The City's revenue)

- How your tax dollars are spent

These tools can help you see how every dollar contributes to services like police, fire, road maintenance, parks, transit, and more.

Latest News

August 29, 2025: City Council on the Agenda – September 2, 2025 and September 3, 2025

Approved Utilities Budget: 2026 Utilities Budget (pdf)

August 29, 2025: Council to consider 2026 Utilities Budget next week

November 24, 2025: Draft 2026 budget released today

December 9, 2025: 2026 Budget approved

More information will be shared as details become available. In the meantime, residents are encouraged to stay informed and engaged through our website and social media channels.